HSBC posts six month profits of £7 billion pounds, an increase of 121% that is likely to be replicated by the other high street banks.

HSBC posts six month profits of £7 billion pounds, an increase of 121% that is likely to be replicated by the other high street banks.Meanwhile most small to medium sized business have struggled to get loans or maintain existing arrangements with the banks. Even the 'Boy' George Osborne says, "Every small and medium-sized company that I have visited in recent weeks has had some problem with their bank - either they have found it difficult to renew their overdraft or the bank demanded additional collateral, often someone's house." Read More Here

Lloyds and RBS, which received billions from the taxpayer to keep them afloat, are set to unveil profits of nearly £1billion between them. In total, Britain's five biggest banks are forecast to return half-yearly profits of £8.4billion. The extraordinary return to profit is also likely to lead to a return of the massive bonuses widely blamed for helping spark the credit crunch.

You might ask yourself, how do they make such big profits? Well, we are giving it to them. You see, the Bank of England borrows money from abroad at a fixed interest rate... something like 3.6% (thats what the fuss about our Triple AAA credit rating is about). Then they lend it to the banks at something like a 1.5% interest rate. The banks then lend to us at 5.5 to 19.5% interest and pocket the difference. The differential between the cost of borrowing for banks from BoE, and from banks to us, is the biggest in history. So we pay inflated interest rates to the bankers and then pay again through our taxes to fund the cheap money the BoE lends to them.

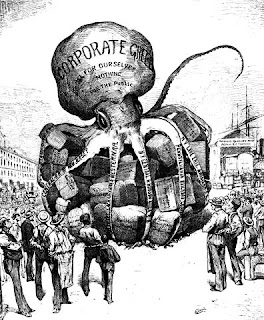

Then the bankers get huge bonuses, that we have paid for, and on which they generally pay the lower rate of Capital Gains Tax! Therefore we as the public are in an effective, lose, lose, lose, lose scenario. Ever feel cheated?

Addendum: On Monday nights Newsnight, financial experts actually argued that we cannot force banks to lend to help small to medium size business... but government could do more! You could not make it up.