According to Workplace Law 30th July, the change to the law is unlkikely to affect private firms as, according to Tom Flanagan, an employment law expert at Pinsent Masons.

According to Workplace Law 30th July, the change to the law is unlkikely to affect private firms as, according to Tom Flanagan, an employment law expert at Pinsent Masons.

"An employer can still justify a mandatory retirement age and use justifications like wanting to balance the workforce and provide opportunities for younger employees," said Flanagan. "The Court of Appeal's ruling sets not that difficult a test, it is not particularly stringent."Therefore the new law is much less than that previously bragged about by the coalition government and falls far short of that currently in the public sector as introduced under the previous government. Previous article read: The coalition government is planning to scrap the default retirement age in the UK from October 2011. Under the proposal, employers would not be allowed to dismiss staff because they had reached the age of 65.

Activists, who have long campaigned against the rule, welcomed the proposal as a "victory" against ageism. Currently, an employer can force an employee to retire at the age of 65 without paying any financial compensation.

The only obligation on an employer is to hold a meeting with the member of staff to discuss plans at least six months before their 65th birthday. At the end of that meeting it is entirely at the discretion of the employer whether or not to terminate employment.

'Unresolved problems'

The government has launched the start of a consultation process about scrapping the rule.

Given that an employer must give six months' notice before forcing someone to retire on the grounds of age, it means the changes could be felt from 6 April next year. After that date, no new forced retirement notices could be issued.

The CBI business group criticised the speed of the proposed changes saying it left firms "with many unresolved problems". The government's timetable to scrap the default retirement age would give companies little time to prepare, it added.

However Rachel Krys of the Employers Forum on Age was delighted, saying it was "really unfair" that people had been forced out of jobs because of their age. "We have to stop these blunt discriminators," she added. The charity Age UK, which has led the campaign to end the default retirement age, welcomed the government's plan. Last year it challenged the rule in the High Court but was unsuccessful. "We've fought really hard to get government to do this," a spokesman said. "It is a massive win for hundreds of thousand of employees who are at risk of being forced out of their jobs."

Economic benefit

David Yeandle of the Engineering Employers Federation: "It will make it more difficult for workforce planning" Proposals to change the retirement law formed part of the government's Coalition Agreement, and was included in both parties' manifestos, but previously no deadline had been set. The government hopes the change will encourage people to work for longer, against a background of an ageing population. That could ease the strain on public finances as more people continue to pay tax, while at the same time claiming the state pension.

Activists have argued it could inject billions of pounds extra into the economy.

But some employers are worried it will complicate the job of managing a workforce and add to overall costs.

We would be interested in members views.

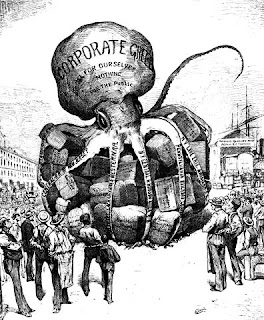

George Osborne's budget is described as 'clearly regressive' by respected fiscal thinktank Institue for Fiscal Studies.

George Osborne's budget is described as 'clearly regressive' by respected fiscal thinktank Institue for Fiscal Studies.